Gallery

Photos from events, contest for the best costume, videos from master classes.

|  |

| |

|  |

|  |

|  |

|  |

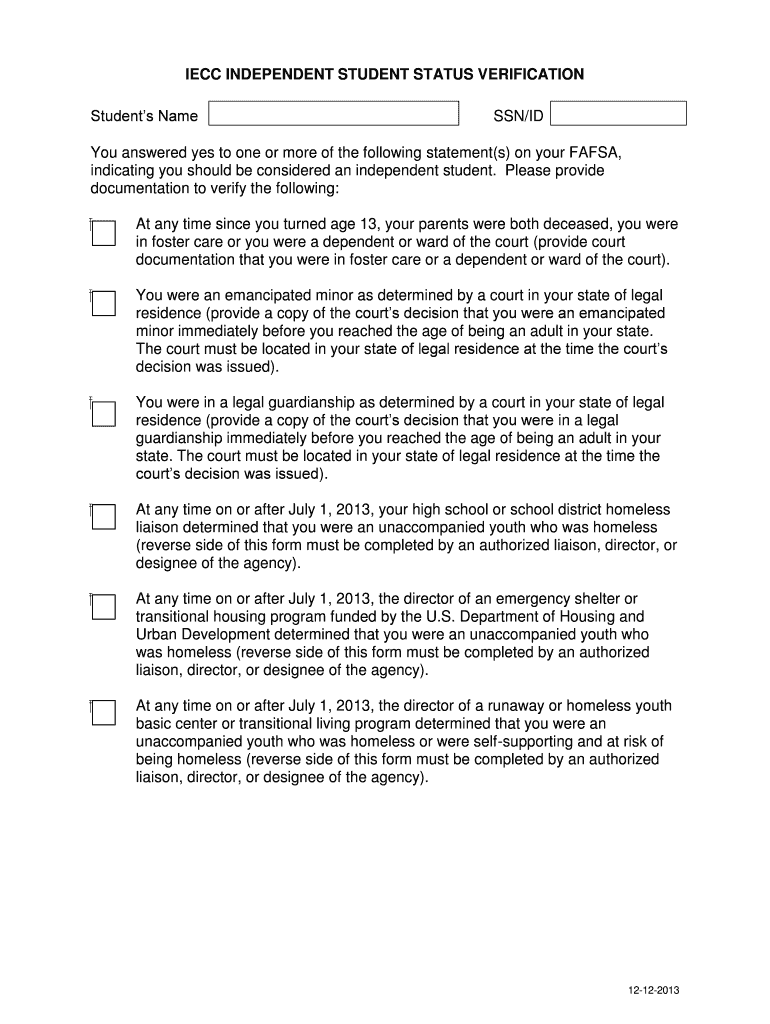

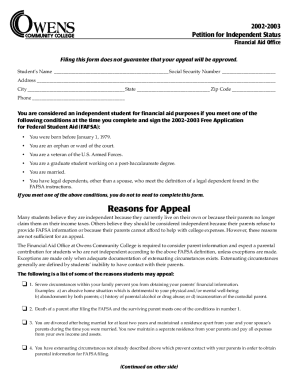

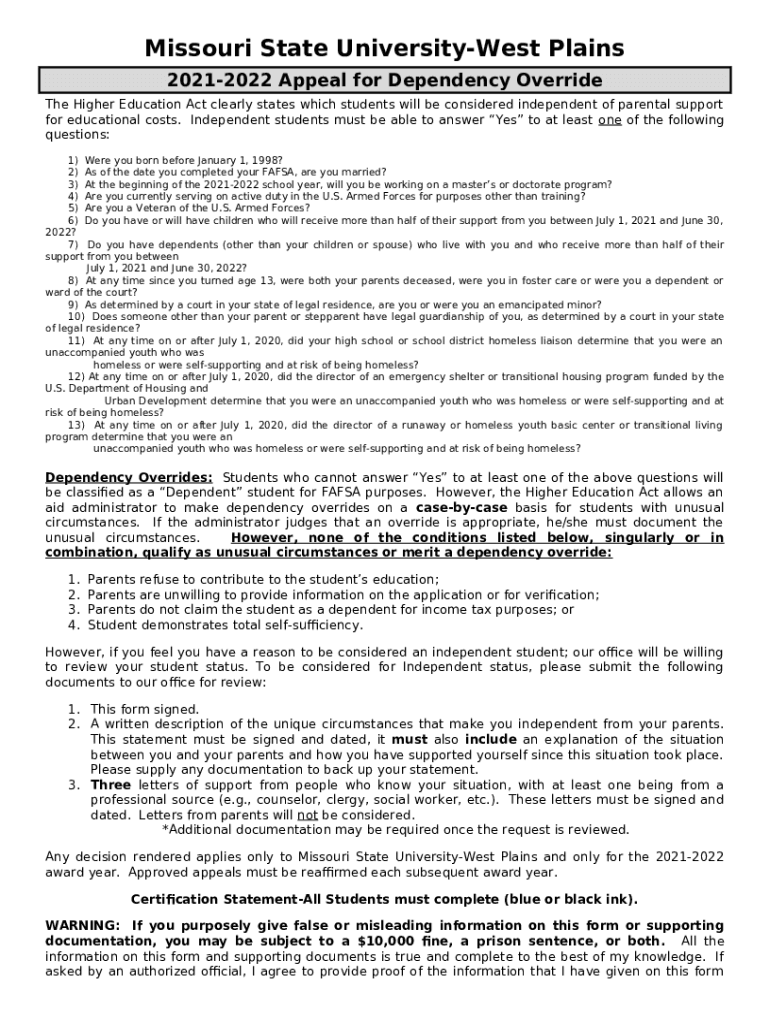

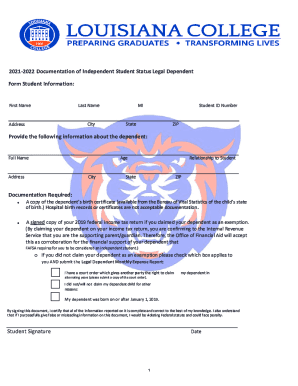

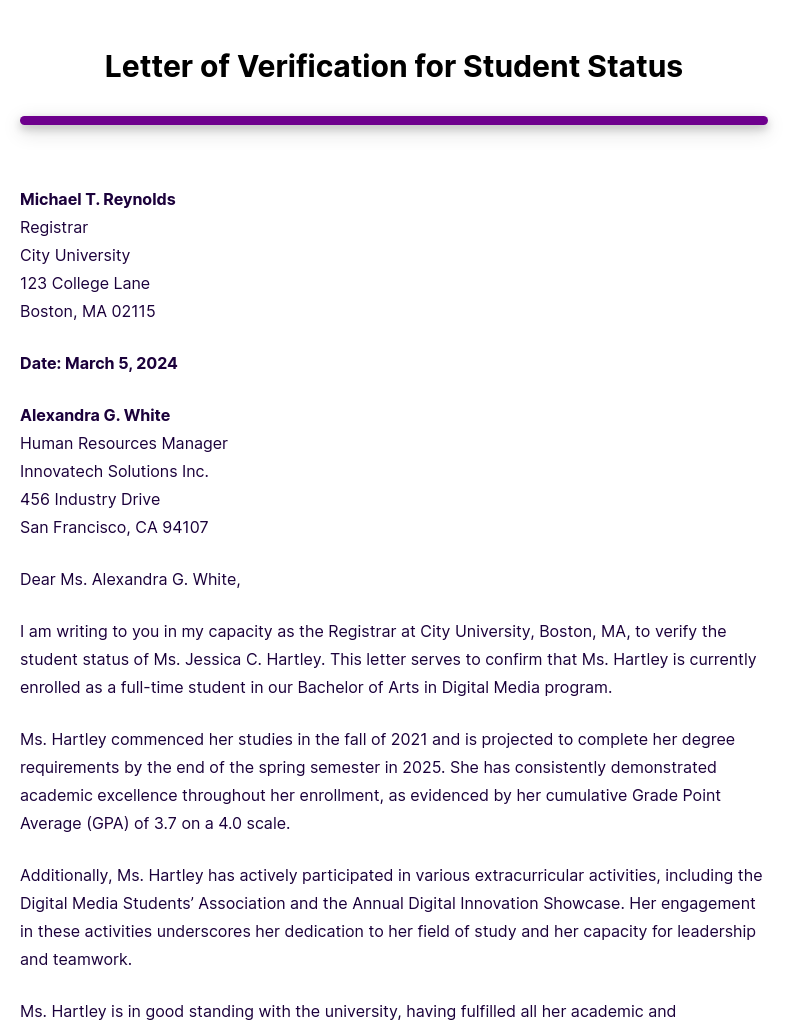

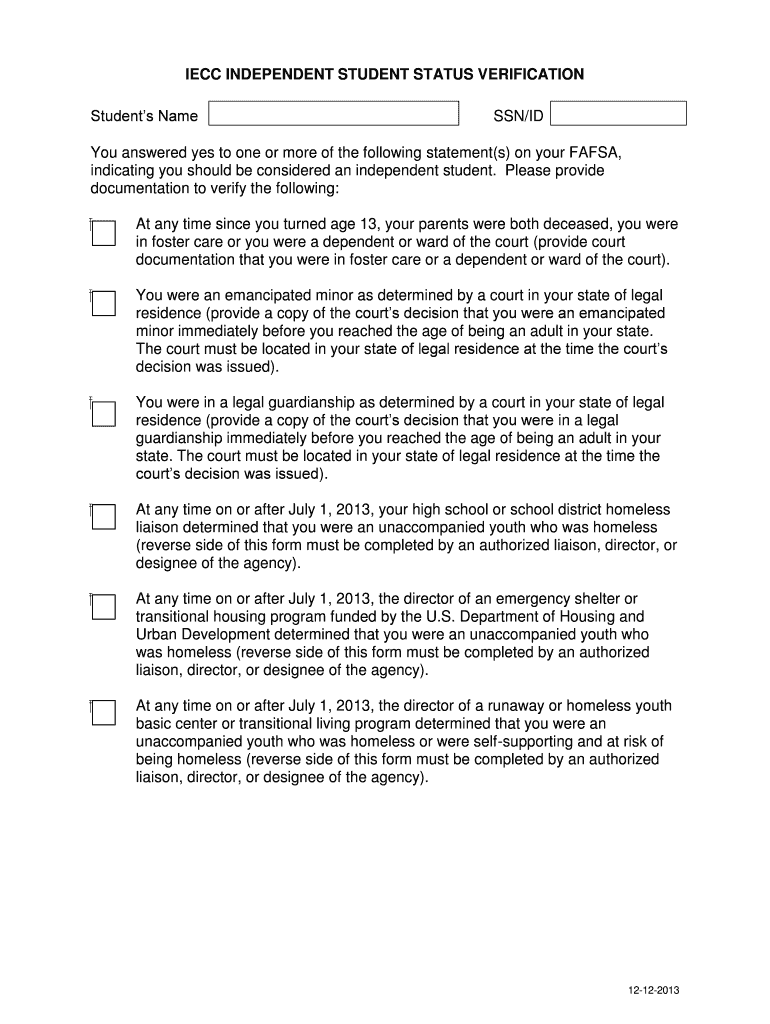

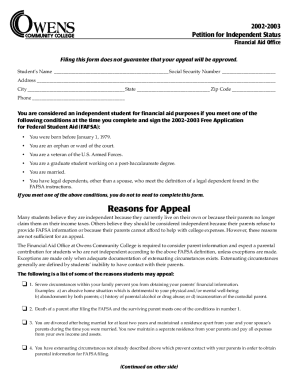

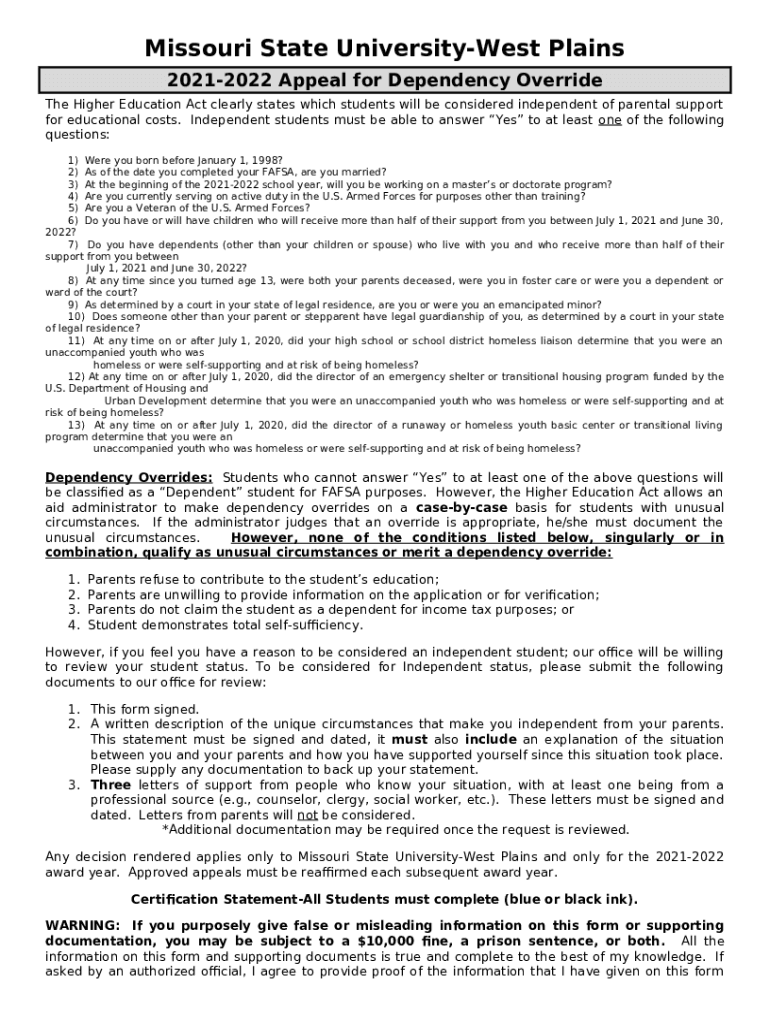

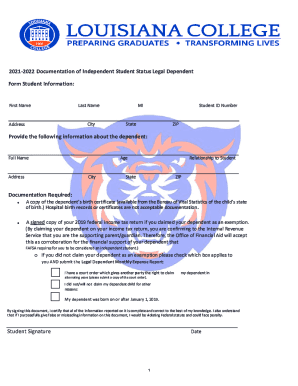

How to Declare Yourself Independent This resource explores the difference between an independent and dependent student. Visitors learn whether they can appeal their dependency status. This page breaks down the process of declaring yourself an independent student with the federal student aid office and your college. The resource also covers tax credits available to independent students. The U.S. Department of Education has clear guidelines when determining if you are a dependent or independent student. Your dependency status is determined when you complete the FAFSA. If you answer ‘yes’ to one of the questions below when completing the application, your dependency status will need to be verified. For the 2025–2026 year, you can be deemed an independent if you meet any To automatically count as an independent student, you must be one of the following: Determined to be an unaccompanied youth who was homeless or self-supporting and at risk of being homeless. Independent students meet certain legal requirements to receive financial aid to pay for college based on the student's ability to pay. When it comes to filing for financial aid through FAFSA as an independent student, one of the key criteria to consider is your age. In order to be classified as independent, you must meet the age requirement set by the Department of Education. Defining Independent Student Status. Before embarking on the FAFSA application, it’s paramount to accurately determine your dependency status. The Department of Education defines an independent student as someone who meets one or more specific criteria. Are you a high school student living independently from your parents? Here's help with the FAFSA and getting the help you need from colleges. If you answer YES to ANY of these questions, then you may be an independent student. You may not be required to provide parental information on your Free Application for Federal Student Aid (FAFSA) form. Find out if you qualify as an independent student when filing the FAFSA -- or if you still need to include your parents' information on the federal financial aid application. Students who fall into several categories based on their age, household members, marital status, educational program, and military status automatically qualify as independent students. Those who do not meet these requirements can file an appeal on their FAFSA or with their school. Students who are 24 at the time of filing or who turn 24 by December 31 of the award year are automatically considered independent. If you are under 24, you might be considered independent for federal aid purposes if: To be considered independent on the FAFSA without meeting the age requirement, an associate or bachelor's degree student must be at least one of the following: married; a U.S. veteran; in For US Federal Student Aid, you must provide both of your parents' incomes unless you can get an override (extremely rare) or can be considered independent. In order to get declared independent, you must be able to answer Yes to one of these questions: If you’re an independent student, you’ll report your own information (and, if you’re married, your spouse’s). Find out who needs to provide parent information on the FAFSA form, and learn what to do if you aren’t in contact with your parents. Make photocopies of documentation that shows you meet the criteria for independent students. This might include your birth certificate, a marriage certificate, birth certificates for children, proof of orphan or former ward of the court status, proof of veteran status from the U.S. military or proof of progress toward a graduate degree. To be considered an independent student, one of the following conditions must apply: You are 24 years of age or older by January 1 of the school year for which you are applying. You’re married to or separated from your spouse, but not divorced. You will be working towards your master’s or doctorate degree. Is it easy to get independent student status for financial aid eligibility? Find out now. Your dependency status determines whose information you must report when you fill out the FAFSA form: If you’re a dependent student, you’ll report your and your parents’ information. If you’re an independent student, you’ll report your own information (and, if you’re married, your spouse’s). Am I Dependent or Independent When I Fill Out the FAFSA® Form? When I fill out the 2023–24 Free Application for Federal Student Aid (FAFSA®) form, will I have to provide information about my parent? It’s not easy to become a FAFSA independent student, but it’s the right choice for certain people. This article explains how this status works, its challenges, and its advantages. It also outlines the steps for filing the Free Application for Federal Student Aid (FAFSA) as an independent student.

Articles and news, personal stories, interviews with experts.

Photos from events, contest for the best costume, videos from master classes.

|  |

| |

|  |

|  |

|  |

|  |